Transportation costs are no longer just a line item. They are a strategic lever for business growth.

In 2024, U.S. business logistics costs reached $2.6 trillion, or 8.7% of the national GDP. The quiet story sits underneath it: duplicate bills, misapplied accessorials, rate tables living in spreadsheets, and approvals that happen after the money is gone.

Transportation spend management (TSM) fixes that by turning freight finance into a system: clear rules, clean data, and automation where it matters.

This guide shows you how to map the freight spend lifecycle, put governance around it, and roll out automation in phases so logistics and finance can make faster, smarter decisions.

What is Transportation Spend Management?

Transportation spend management is the end-to-end process of tracking, validating, analyzing, and optimizing every cost tied to moving goods.

Many teams confuse TSM with freight audit and payment. Audit and payment is important, but it is only one slice. True TSM starts earlier (contract and tender) and ends later (accruals, forecasting, and negotiation leverage).

Research suggests that 20% to 30% of freight bills contain discrepancies, from incorrect fuel surcharges to accessorials that were never approved. Catch those issues before payment and you protect margin. Trend them over time and you gain leverage with carriers.

A mature TSM program often reduces total transportation spend by 5% to 10%, depending on shipment mix and baseline process maturity.

Here is a simple way to separate the overlapping terms:

| Concept | What it covers | What success looks like |

|---|---|---|

| TMS (Transportation Management System) | Planning and executing shipments (tendering, tracking, carrier selection) | On-time delivery, strong carrier compliance, fewer manual touches |

| Freight audit & payment | Checking carrier invoices and paying them | Fewer overcharges and faster, cleaner payments |

| TSM (Transportation Spend Management) | The full freight finance lifecycle, plus analytics and governance | Spend is accurate, attributable, forecastable, and optimized |

If you are only auditing invoices, you are reacting at the end. TSM gives you control across the full lifecycle.

The End-to-End Transportation Spend Lifecycle

To manage spend, you need to see where costs are created and where errors enter. Below is a common workflow for a modern freight transaction, with typical failure points called out.

- Tender & Rate Confirmation: Operations selects a carrier based on contract rates, routing guide logic, or spot quotes. Errors begin when the rate source of truth is not digitized, or when spot quotes live in email threads that finance never sees.

- Execution & Visibility: The shipment moves. Documents like the Bill of Lading (BOL) and Proof of Delivery (POD) are generated. If weights, classes, or accessorial triggers are missing or inconsistent, disputes get harder later.

- Invoicing (EDI 210 / PDF): The carrier invoices you. High-volume shippers often receive EDI 210 transactions, while smaller operations get PDFs. PDFs increase manual entry risk and delay audit timing.

- Audit & Dispute: The invoice is matched to the agreed rate and shipment facts. Discrepancies often come from accessorials. Industry reporting consistently shows accessorial errors as a major driver of LTL invoice problems (for example, AFS highlights how common these issues are).

- Approval & GL Coding: Valid invoices must be coded correctly (lane, business unit, customer, project, product line). If coding happens late or inconsistently, spend analysis turns into guesswork.

- Payment & Accruals: Finance pays the carrier and records liabilities. Without strong accrual logic, month-end close becomes a scramble, especially when freight is delivered but not yet billed.

The practical takeaway: many invoice disputes trace back to upstream data capture, especially rates and shipment facts.

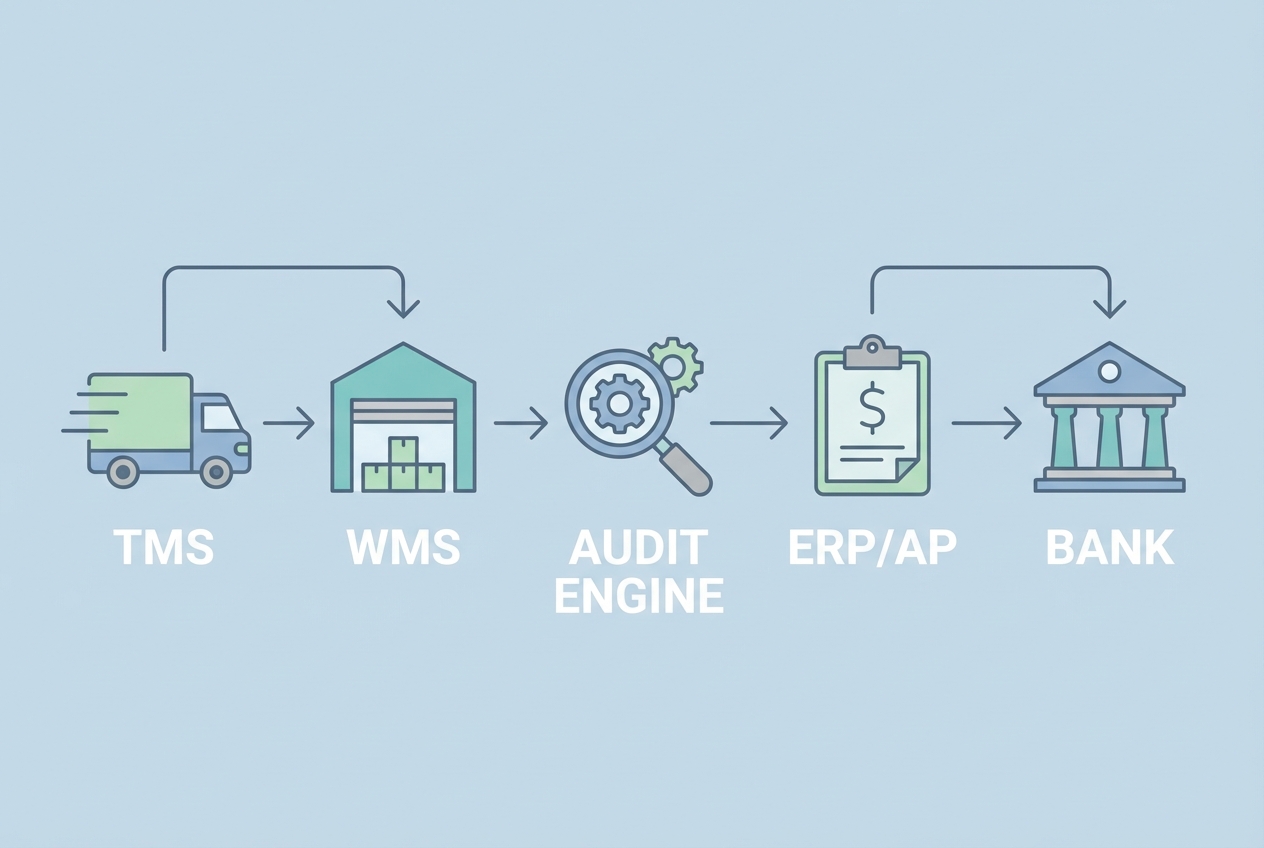

Systems Map: Integrating TMS, ERP, and AP

A clean systems map is the foundation of clean spend.

A common failure in transportation spend management is data silos. Operations has rates in the TMS. Finance has invoices in AP. The warehouse has weights and dimensions. Nobody has one version of the truth.

To achieve full visibility, your systems must communicate in a predictable way:

-

TMS (Transportation Management System): The execution hub. It holds carrier contracts, contracted rates, routing rules, and shipment status.

-

WMS (Warehouse Management System): The physical truth. It provides weights, dimensions, and handling events, which matter for freight class, billing basis, and 3-way matching.

-

ERP/Accounting (for example, NetSuite or SAP): The financial system of record where liabilities, GL coding, and payments ultimately live. It is also where reconciliation happens.

-

AP Automation: The invoice processing layer that captures invoices, detects duplicates, and routes approvals.

-

Data flow example: When a carrier sends an EDI 210 invoice, an automated TSM layer should pull the original rate from the TMS, verify key shipment facts (like weight) from the WMS, apply audit rules, and then push a "ready-to-pay" transaction into the ERP via API.

This is also where lightweight custom software can pay off fast. When your rate logic or exception paths are unique, a small automation layer can connect the gaps without a long IT backlog. Quantum Byte teams often start by prototyping the workflow from natural language, then add integrations once the rules are proven in production.

Controls & Governance in Transportation Finance

Automation without governance just moves problems faster. A strong TSM program needs controls so the process stays trusted as volume increases.

Every transportation finance program should implement these pillars:

-

Separation of duties (SoD): Ensure the person tendering the shipment is not the same person approving the freight invoice. This reduces fraud risk and stops rubber-stamp approvals.

-

Approval thresholds: Create automated triggers so invoices above a dollar amount or variance threshold (for example, more than 5% above the agreed rate) route to a controller for review. This keeps clean invoices fast while protecting you on exceptions.

-

Audit rules library: Maintain a living set of checks that reflect how your carriers actually bill you.

-

Duplicate invoice detection: Catch repeat invoice numbers, repeat BOLs, and re-bills that slip through when the invoice format changes.

-

Fuel surcharge validation: Confirm the correct fuel index, correct lane basis, and correct week applied.

-

Accessorial policy checks: Only allow charges that match your policy and your shipment events (for example, detention requires timestamps).

-

-

Dispute handling: Standardize disputes so they do not die in email. A dispute needs an owner, a reason code, supporting documents, a response SLA, and a closed-loop outcome (approved, denied, credited).

Good governance is what lets you scale throughput without adding headcount or losing confidence in the numbers.

A 3-Phase Roadmap for TSM Automation

Moving from spreadsheets to an AI-powered system works best as a phased rollout with compounding returns.

Phase 1: Visibility (Months 1-3)

Start by making spend legible.

-

Centralize invoices: Pull EDI, PDF, and portal invoices into one place so you can measure volume, cycle time, and error rates.

-

Normalize carrier data: Make sure a lane and a service level mean the same thing across carriers. If you do not normalize, reporting drifts.

-

Baseline KPIs: Track cost per mile, cost per hundredweight (where relevant), invoice exception rate, on-time performance, and dispute cycle time.

Phase 2: Controls (Months 3-6)

Once you can see the spend, lock down the process.

-

Implement automated audit rules: Use 3-way matching (invoice vs. agreed rate vs. POD or shipment facts). Push exceptions to a queue with clear reasons.

-

Automate GL coding: Code based on lane, customer, product line, or department so spend becomes attributable without manual work.

-

Create dispute and chargeback workflows: Disputes should route like tickets, not like emails. Track reasons and outcomes so you can negotiate from facts (see detention vs demurrage automation).

Phase 3: Predictive (Month 6+)

Now you stop managing the past and start managing the future.

-

Use AI for anomaly detection: Spot unusual accessorial patterns, carriers billing outside norms, or lanes that drift in cost.

-

Automate accrual forecasting: Estimate delivered-but-unbilled freight in near real time, so finance can close faster with fewer surprises.

-

Predict exception risk: Flag shipments likely to generate disputes based on historical carrier behavior, facility dwell times, or lane volatility.

Resources for Transportation Finance Leaders

For deeper dives into specific automation workflows, explore these guides:

-

Audit readiness: Freight Bill Audit Automation Checklist

-

Operational definitions: Freight Audit and Payment Explained

-

Cost management: Automating Accessorial Charges and Fuel Surcharge Calculation Automation

-

Chargeback strategy: Detention vs. Demurrage Automation

-

Technical implementation: TMS Integration with Accounting & ERP

Future-Proofing Your Freight Spend

Supply chains are not getting calmer. Fuel swings, capacity shifts, and service disruptions are now normal. That makes transportation spend management a strategic necessity, not a finance cleanup task.

Future-proofing comes down to three moves:

-

Make rates and rules machine-readable: If your true rate lives in PDFs or inboxes, you cannot automate spend with confidence.

-

Connect execution to finance: Your TMS knows what should happen. Your ERP knows what got paid. Bridging them is where visibility and control are created.

-

Turn exceptions into intelligence: Every dispute reason is a data point. Trend it, fix upstream causes, and negotiate from proof.

If you want to move quickly without a long IT backlog, start with a simple audit-and-approval flow, prove value, then connect it to your systems. When you are ready to build, Quantum Byte can help you turn that workflow into production software in days, not months.

Automate your transportation spend workflows with Quantum Byte

Turning Freight Spend Into a Competitive Advantage

Transportation spend management works when you treat it like an operating system for freight finance: repeatable rules, clean handoffs, and data you can trust.

This guide covered what TSM is (and what it is not), the full freight spend lifecycle, the systems map that connects operations to finance, the controls that keep spend governed, and a three-phase automation roadmap that moves from visibility to predictive management.

The outcome is straightforward: fewer billing errors paid, faster close, cleaner reporting, and a logistics team that can negotiate and optimize from real data instead of assumptions.

Frequently Asked Questions

What is the difference between TMS and TSM?

A TMS focuses on planning and executing shipments. TSM focuses on the financial lifecycle and optimization of transportation costs, from contract rates to audit rules to accruals and reporting. Many organizations add a TSM layer to connect TMS execution data to ERP payment data.

How much can a company save with transportation spend management?

Savings vary by maturity and shipment mix. Many teams see meaningful savings just from preventing common billing errors, especially accessorial issues (AFS provides examples of how frequent these errors can be in LTL billing). More advanced programs can add additional savings through lane governance and contract renegotiation.

What are common errors in freight invoices?

Common issues include accessorials that do not match shipment events, fuel surcharge misapplication, duplicate invoices, and incorrect classifications (especially in LTL). These problems often start upstream with inconsistent shipment data or unclear rate sources.

How does AI improve transportation spend management?

AI helps by spotting anomalies across large invoice volumes, predicting which shipments are likely to generate exceptions, and improving accrual forecasts for unbilled freight. The practical benefit is less manual review and earlier detection of spend drift (see financial reporting automation).

Why is EDI 210 important for spend management?

EDI 210 is a standardized electronic invoice format used by many carriers. It reduces manual entry and speeds up automated auditing because the invoice arrives as structured data instead of a PDF that needs re-keying or OCR.