Businesses lose an average of 5% to 8% of their annual shipping spend to billing errors and overcharges, yet many logistics teams still rely on manual, error-prone reviews. With freight costs climbing nearly 28% since 2021, the transition from manual spot-checks to automated, rule-based audits is no longer optional if you want to protect margin.

This guide gives you a checklist-driven framework to turn freight bill audit from a back-office headache into a repeatable cost-control engine. You will get audit rules you can copy, evidence requirements for disputes, and a blueprint for building an AI-powered workflow that can cut processing costs.

The Strategic Importance of a Freight Bill Audit

A freight bill audit does more than check the math. It acts as a financial control that confirms every carrier invoice matches:

-

Contract alignment: The rates, discounts, minimums, and surcharge logic you negotiated.

-

Tender accuracy: The mode, service level, accessorial requests, and special instructions you actually tendered.

-

Execution proof: What happened in transit and at the dock, backed by documents and timestamps.

That is the difference between having a guess and having an audit trail.

Why this matters beyond recoveries

Most teams start auditing to stop overpayments. That is a smart first move, but the bigger win is control.

A disciplined freight bill audit creates clean, trusted cost data. That data is what powers:

-

Transportation spend management automation: If invoice data is messy, automations fail and dashboards lie. If invoice data is clean, you can build real controls and forecasting on top of it.

-

Faster closes and cleaner accruals: When invoices arrive late, finance estimates. When audit logic is consistent, your accruals tighten and month-end gets easier.

-

Stronger contract discipline: If a carrier frequently bills accessorials that were not requested, you can tighten tender rules, retrain teams, or renegotiate terms.

-

Better cash flow control: Pre-payment audit protects cash. Post-audit recovery protects your P&L, but cash already left your account.

-

Fraud and internal control protection: Duplicate bills and rebills happen. A structured audit reduces the chance of paying twice, paying the wrong party, or paying outside contract terms.

When you do it consistently, you unlock three compounding wins:

-

Fewer overpayments: You catch rate mistakes, duplicate bills, and accessorial fees that were never earned.

-

Cleaner freight data: Your invoice data becomes reliable enough to power forecasting, carrier scorecards, and network changes.

-

Better leverage with carriers: Audit trends show which lanes, terminals, or service types produce recurring errors, so you can negotiate from facts, not frustration.

Done well, a systematic audit can improve the bottom line by up to 15% through recoveries, tighter controls, and better contract discipline.

The Essential Freight Bill Audit Checklist

To reach 99% data accuracy, you need to follow a checklist that is both strict and practical. Use the grouped steps below whether you run a pre-payment audit (strongest control) or a post-audit recovery process (still valuable, but slower to translate into savings).

1) Pre-Audit Preparation

-

Centralize invoice intake: Pull EDI 210 files, PDFs, email invoices, and portal downloads into one intake stream so nothing gets missed.

-

Normalize data formats: Map different carrier layouts into one consistent schema (a single “shape” of data). This is where most manual audit time disappears.

-

Verify the Bill of Lading (BOL): If you cannot tie an invoice to a valid BOL, you do not have a clean trail for approval or disputes.

-

Confirm master data: Ensure shipper/consignee names, locations, and carrier IDs match what your TMS/ERP expects, or your matching rules will break.

2) Rate & Contract Audit

-

Match billed linehaul to your TMS or rate table: Compare the invoice to the contracted lane rate, quote, or routing guide rule.

-

Verify lane minimums and routing guide compliance: Many “small” errors are really routing guide misses (wrong mode, wrong carrier, wrong service level).

-

Check freight classification: Validate NMFC or class rules where relevant, especially in LTL where class drives cost.

-

Validate dimensional logic (parcel and air): Confirm billed weight basis (actual vs. dimensional) aligns with your contract and package data.

3) Accessorial & Surcharge Validation

-

Recalculate fuel surcharges: Do not trust the FSC line. Recompute fuel using the index and multiplier you agreed to (for example, using U.S. EIA fuel price data when your contract references a published index).

-

Verify detention and demurrage: Confirm against GPS timestamps, appointment logs, yard management data, or warehouse check-in and check-out records.

-

Confirm specialized services were requested: Liftgate, inside delivery, residential, limited access, and appointment fees must match the tender and shipment notes.

-

Check “minimum charge” behavior: Some contracts allow minimums, some do not. Either way, minimums should be predictable, not a surprise line item.

4) Proof of Performance

-

Cross-check POD dates and locations: Compare the Proof of Delivery (POD) date and location against the billed service date to prevent billing drift.

-

Trigger claims for issues noted on POD: Shortages, damage notes, or refused freight should kick off a claims workflow, not a blind payment.

-

Validate service level delivery commitments: For guaranteed services, late delivery may trigger refunds or credits depending on your carrier terms.

5) Approval & GL Coding

-

Assign the right cost center and GL code: Use consistent business rules so finance gets clean reporting without rework.

-

Flag exceptions for workflow review: Route issues to the right owner and connect it to your AP automation process so exceptions do not die in inboxes.

-

Enforce approval thresholds: For example, auto-approve invoices under a variance threshold, and require human approval above it.

Common Freight Bill Audit Rules with Practical Examples

Some firms report that as many as 80% of invoices contain errors. That does not mean 80% are massive overcharges. It means most invoices contain something you should verify, even if the final payable amount stays the same.

The goal of rules is consistency. A rule is a “logic gate” that produces a clear outcome:

-

Pass: Auto-approve because invoice data matches contract and proof.

-

Fail: Route to an exception queue because a rule variance was triggered.

-

Hold: Pause payment because required evidence is missing (often POD, reweigh, or a tender file).

Below are high-value rules, with examples you can translate into automation quickly.

Duplicate invoice detection

-

Duplicate key match: Flag any invoice sharing the same carrier + PRO number (LTL) or tracking number (parcel), or the same container + voyage (ocean).

-

Near-duplicate match: Flag invoices from the same carrier with the same amount and ship date within a short window. This catches rebills and re-submissions that changed the invoice number.

-

Split billing validation: If a carrier splits linehaul and accessorials into separate invoices, require a shared reference ID so you can group them.

Practical example: You receive two invoices with the same PRO number. One is marked “rebill.” Your system should automatically check whether the first invoice was paid, short-paid, or rejected, then route the second invoice accordingly. Pair this with duplicate invoice detection rules so you never pay twice for the same move.

Contracted vs. billed rate validation (linehaul and discounts)

-

Expected rate calculation: Use the contract basis (per mile, per hundredweight, zone-based, or tariff-minus discount) to calculate the expected charge.

-

Variance thresholds: Set a tolerance, such as $5 or 1%, to avoid routing noise. Tolerance should be policy-driven, not random.

-

Quote precedence: Decide whether spot quotes override contracted rates, and store the quote reference so the audit can match it.

Practical example: Your contract says $2.5/mile for a 500 mile lane, so expected line haul is $1,250. The invoice shows $1,400. The system should trigger a rate variance exception, attach the contract lane record, and compute the delta.

Accessorial validation (earned vs. unearned fees)

Accessorials are where “death by a thousand cuts” lives.

-

Tender-required accessorials: Liftgate, inside delivery, residential, and appointment fees should be present in the tender or shipment instructions, not added later.

-

Conditional accessorials: Detention and re-delivery require evidence and time thresholds.

-

Mutually exclusive accessorials: Some fees should not appear together (for example, “attempted delivery” and “delivered” on the same stop, unless clearly documented).

Practical example: A carrier bills for liftgate. Your tender does not request it. The audit should fail the line item and require proof: a POD note, receiver acknowledgement, or a carrier service record. If evidence is missing, dispute.

Fuel surcharge validation (index, peg, and effective date)

Fuel is often calculated correctly by the carrier’s system, but “correct” depends on the index and the effective date your contract specifies.

-

Index source: Confirm the index referenced (DOE/EIA, carrier index, lane-based index).

-

Peg and multiplier: Validate the peg point and multiplier used in the formula.

-

Effective date rule: Lock the index to ship date, pickup date, or invoice date based on the contract definition.

Practical example: Your contract uses a weekly index based on ship date. The carrier applies Monday’s index to a Friday shipment, raising the FSC. The audit should detect the mismatch and adjust to the correct week. Over hundreds of shipments, this becomes real money.

Reweigh, reclass, and dimensional weight (LTL and parcel)

These are common and often legitimate. They also require proof.

-

Reweigh evidence: Require a reweigh ticket or certified scale record.

-

Reclass evidence: Require classification rationale (NMFC change) and shipment details that justify it.

-

Dimensional evidence: Require package dimensions from your WMS/cartonization system and compare to billed dimensions.

Practical example: A parcel carrier bills 18 lb dimensional weight instead of your 10 lb actual weight. If your carton dimensions support 18 lb, approve. If not, dispute with package evidence.

Minimum charge and deficit weight validation (LTL)

Carriers often apply minimum charges or deficit weights based on tariff rules. Your audit should ensure they match your contract.

-

Lane minimums: Validate minimums by lane and service level.

-

Deficit weight rules: Confirm that deficit weight rules apply to the shipment and that the deficit weight used is correct.

-

Discount application order: Ensure discounts apply in the right order (tariff, then discount, then accessorials, if that is how your contract is written).

Practical example: Your LTL contract has a $175 minimum only for certain lanes. The carrier applies it universally. The audit should detect the lane mismatch and adjust.

Tax/VAT and currency rules (international)

International billing errors can hide in compliance details.

-

VAT logic: Confirm VAT is applied to the correct charges and that VAT IDs are present when required.

-

FX rate basis: Ensure FX uses the service date basis defined in your policy (often pickup date or delivery date).

-

Incoterms awareness: If your Incoterms shift who pays which charges, your audit should enforce that responsibility.

Practical example: A forwarder invoices in EUR, but your policy converts using the pickup-date FX rate. The invoice uses the billing-date rate. The audit should recalculate and adjust, then document the basis.

A simple rule summary you can implement first

| Rule | What it catches | Data you need | Typical disposition |

|---|---|---|---|

| Duplicate | Same shipment billed twice | Carrier ID, PRO/tracking, ship date, amount, payment history | Reject or hold |

| Rate variance | Linehaul does not match contract/quote | Contract rate table, lane, miles/weight, quote ID | Short-pay or dispute |

| Fuel variance | Wrong index week or wrong formula | Contract FSC formula, index source, ship/pickup date | Adjust/short-pay |

| Unearned accessorial | Liftgate/residential/inside delivery added later | Tender file, shipment notes, POD notes | Dispute |

| Detention variance | Detention billed without time proof | Appointment windows, check-in/out times, GPS pings | Dispute or approve partial |

If you are building this as automation, start with the rules above. They create high savings with low complexity, and they strengthen your control environment fast.

Managing Exceptions: The Audit Resolution Matrix

Automation does not eliminate exceptions. It makes exceptions visible, categorized, and fast to resolve. The matrix below is a strong starting point because it ties each exception to required evidence, a response deadline, and the correct action.

| Exception Type | Audit Rule | Required Evidence | SLA | Disposition |

|---|---|---|---|---|

| Rate variance | Billed > Contract | Rate table / TMS quote | 48 hrs | Short-pay |

| Duplicate bill | PRO/carrier match | Previous payment record | 24 hrs | Reject |

| Un-tendered accessorial | Not in tender | Tender file / POD | 72 hrs | Dispute |

| Missing POD | Delivery verification | Signed proof of delivery | 5 days | Hold payment |

| Fuel overcharge | Index mismatch | DOE weekly average | 48 hrs | Adjust/pay |

Two implementation notes that matter in the real world:

-

Short-pay policy consistency: If you short-pay, you need a clear remittance reason code and supporting detail, or you will create rework later.

-

Named exception ownership: Assign each exception to a specific person (or role with a named backup), so issues do not stall in a generic team queue.

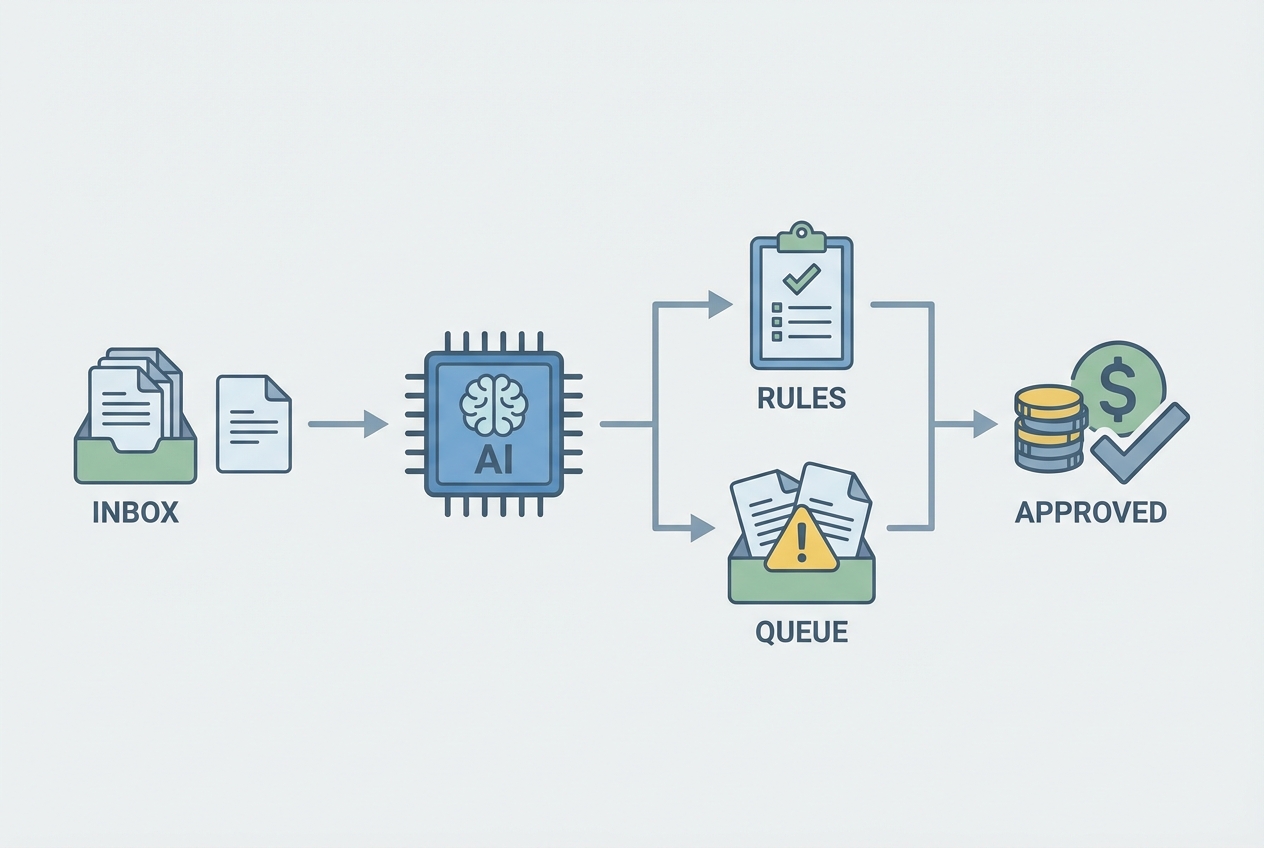

Automation Blueprint: Implementing AI-Driven Audit Workflows

An automated audit is a system: intake, normalization, rules, exceptions, approval, and feedback.

An automated audit is a system: intake, normalization, rules, exceptions, approval, and feedback.

If you are still living in spreadsheets, your biggest cost is not just overcharges. It is the time you burn pulling documents, re-keying fields, and chasing missing proof.

Quantum Byte helps shippers move away from manual review by building a custom AI-driven rules engine that matches your contracts, your carriers, and your approval culture.

- Invoice intake: AI document extraction pulls data from PDFs, emails, and portals. This is how you get near 99% extraction accuracy without forcing EDI on every small carrier.

- Normalization: The system standardizes fields so “FSC” and “Fuel Surcharge” become one field, and carrier-specific codes map to your internal naming. Normalization is what makes audit rules reusable.

- Rule execution: Run the 3-way match (invoice vs. contract vs. POD). In practice, this is a set of validations that run in seconds, every time, exactly the same way. If you are building this from scratch, patterns from workflow automation software help define clean handoffs and ownership.

- Exception queue: Route variances to the right person with context attached. Rates go to logistics. Duplicate concerns go to AP. Missing POD goes to the carrier management owner.

- Payment and short-pay: Approved amounts push to your ERP for payment. Disputes generate structured notices for carriers, with evidence links and clear reasons.

- Feedback loop: Audit data feeds back into your TMS and procurement process. Recurring errors become negotiation leverage. They are also a reason to tighten routing guide rules.

Workflow diagram description: Invoice intake (PDF/EDI) → Data normalization (AI extraction) → Rule engine checks (rate/accessorial/duplicate) → Exception queue (logic triggered) → Stakeholder approval → Payment/short-pay execution → Carrier feedback/contract update.

Optimizing the Bottom Line with Quantum Byte

When freight audit becomes a repeatable system, two things happen fast: your overpayments drop, and your team gets time back.

You also improve carrier relationships. Accurate, fast payments build trust. Clear disputes with evidence reduce back-and-forth and stop the rebill loop.

The most valuable upgrade is visibility. When your audit workflow connects to financial reporting automation, you get a real-time view of true landed costs by lane, customer, product line, or region. That is where better decisions start.

Ready to automate your freight audit and payment workflow? Build your first audit automation with Quantum Byte today!

Your Freight Audit System, Now Mapped

You now have:

-

A clear audit definition: What a freight bill audit controls and what it must match.

-

A practical checklist: The step-by-step process from intake through GL coding.

-

A rule library starter pack: High-impact rules with examples you can implement quickly.

-

An exception matrix: A way to resolve issues with evidence, SLAs, and clear outcomes.

-

An automation blueprint: A workflow that turns auditing into a daily system, not a monthly scramble.

Next, pick one shipping mode (often LTL or parcel), implement a tight set of rules, and measure results for 30 days. Once the workflow is stable, expand coverage and deepen the rule library. The compounding effect is real: fewer exceptions, faster approvals, and cleaner data that makes every other logistics decision easier.

Frequently Asked Questions

What is a freight bill audit?

A freight bill audit is the process of verifying a carrier’s invoice against contracted rates and service records to find overcharges, duplicates, and billing errors before you pay. Many shippers automate this so the audit runs continuously instead of relying on manual spot checks.

Why is a freight bill audit necessary?

It is necessary because billing errors are common in logistics, and the impact compounds with volume. An audit also creates clean, trusted shipment cost data you can use to negotiate, forecast, and control spend.

How can a freight bill audit save money?

It saves money by catching issues like unauthorized accessorial fees, incorrect fuel surcharge application, duplicate invoices, and rate drift versus contract. It also helps you prevent repeat errors by tracking patterns by carrier, lane, and terminal.

What are common errors found during freight bill audits?

Common errors include duplicate billing for the same PRO number, fuel surcharge misapplication, detention that does not match timestamps, liftgate or inside delivery billed without being requested, and rate variances versus your contract or quote.

Should I outsource or automate my freight audit process?

Outsourcing can work if you need a quick stopgap. Automation is often the stronger long-term move if you want real-time visibility and control. A good approach is to start with intake, normalization, and a small set of high-impact rules, then expand as you learn where your biggest variances live.