In an industry where margins are thin and logistics complexity is high, freight billing errors are surprisingly common. Recent studies show that nearly 25% of all freight bills contain errors, causing shippers to overpay by as much as 13% annually if invoices are left unchecked. For large-scale shippers, managing these discrepancies manually is no longer viable. It demands a robust, end-to-end freight audit and payment (FAP) strategy.

This guide breaks down the essential components of a modern FAP system, from multi-channel data intake to advanced financial controls. You will see how shippers can leverage transportation spend management automation to eliminate manual bottlenecks, improve carrier relationships, and move toward near-100% audit coverage. Whether you are evaluating third-party providers or building an in-house AI-driven solution, the synergy between operations and finance is where the real savings live.

The End-to-End Freight Audit and Payment Process

Your goal with FAP is simple: pay only what you owe, pay on time, and make the data usable for decisions. The hard part is that freight invoices do not arrive clean, consistent, or complete.

A modern process maps the full lifecycle of a shipment charge from tender to general ledger (GL) posting, with controls at every step.

Workflow stages (from tender to GL)

-

Intake & normalization: Invoices arrive through EDI, PDFs, portals, or email. The system captures them, extracts fields, and converts them into a standard structure. Once the data is normalized, you can apply one set of rules across every carrier.

-

The audit engine (3-way match): The engine compares invoice lines against:

-

Contracted rates and fuel programs: Confirms base rates, fuel index logic, minimum charges, discounts, and effective dates.

-

Shipment records from your TMS: Validates mode, lane, stops, weight, class, and reference numbers like PRO and BOL.

-

Proof signals like delivered status, appointments, or POD references: Confirms the service was completed. It also tests whether timing-based charges are even plausible.

This is the core "should we pay this?" decision.

-

-

Exception management: Any mismatch (rate, lane, weight, accessorial, duplicates) becomes an exception. The system assigns ownership and records a reason code. It also tracks resolution so you do not relive the same dispute every month. Strong teams add SLAs here, such as "detention disputes resolved in 7 business days." They also track repeat offenders by carrier and lane.

-

Approval & payment: Valid invoices route through your approval matrix (department, mode, dollar thresholds). After approval, treasury executes payment via ACH, wire, check, or virtual card based on policy and carrier preference.

-

Financial reporting: Charges get GL-coded, accrued, and posted into your ERP with clean dimensions (carrier, lane, cost center, customer, project, mode). This is where transportation becomes a controllable spend category instead of a monthly surprise.

Why "operations + finance" beats "finance alone"

If you run FAP as a finance-only function, you will miss the context that explains charges. If you run it as an ops-only function, you will miss the controls that prevent duplicate payments, approval bypasses, and messy accruals.

A strong setup creates one shared source of truth:

-

Operations: Validates service and accessorial reality. This covers what happened on the dock, in transit, and at delivery.

-

Finance: Validates policy, budget, GL mapping, and payment controls. This covers what should be paid and how it should be recorded.

Where custom AI solutions fit (especially with legacy systems)

Many teams hit the same wall: the TMS has data, the ERP has rules, and invoices arrive as a pile of unstructured documents. The gap is integration and normalization.

This is where Quantum Byte’s custom AI solutions can be practical. Instead of forcing a rip-and-replace TMS or waiting on a long ERP project, you can build a lightweight "FAP layer" that:

-

Pulls shipment truth from the TMS: Uses the system of record you already have, even if it is older or lightly customized.

-

Extracts invoice truth from PDFs and portals using AI: Captures the billed reality without hiring people to re-key line items.

-

Enforces audit rules you control: Applies contracts, routing guides, and business policies with clear versioning.

-

Posts clean entries back into your accounting system: Sends approved, coded transactions to your ERP so reporting stays reliable.

That is the difference between reviewing invoices and running a system that prevents overspend by design.

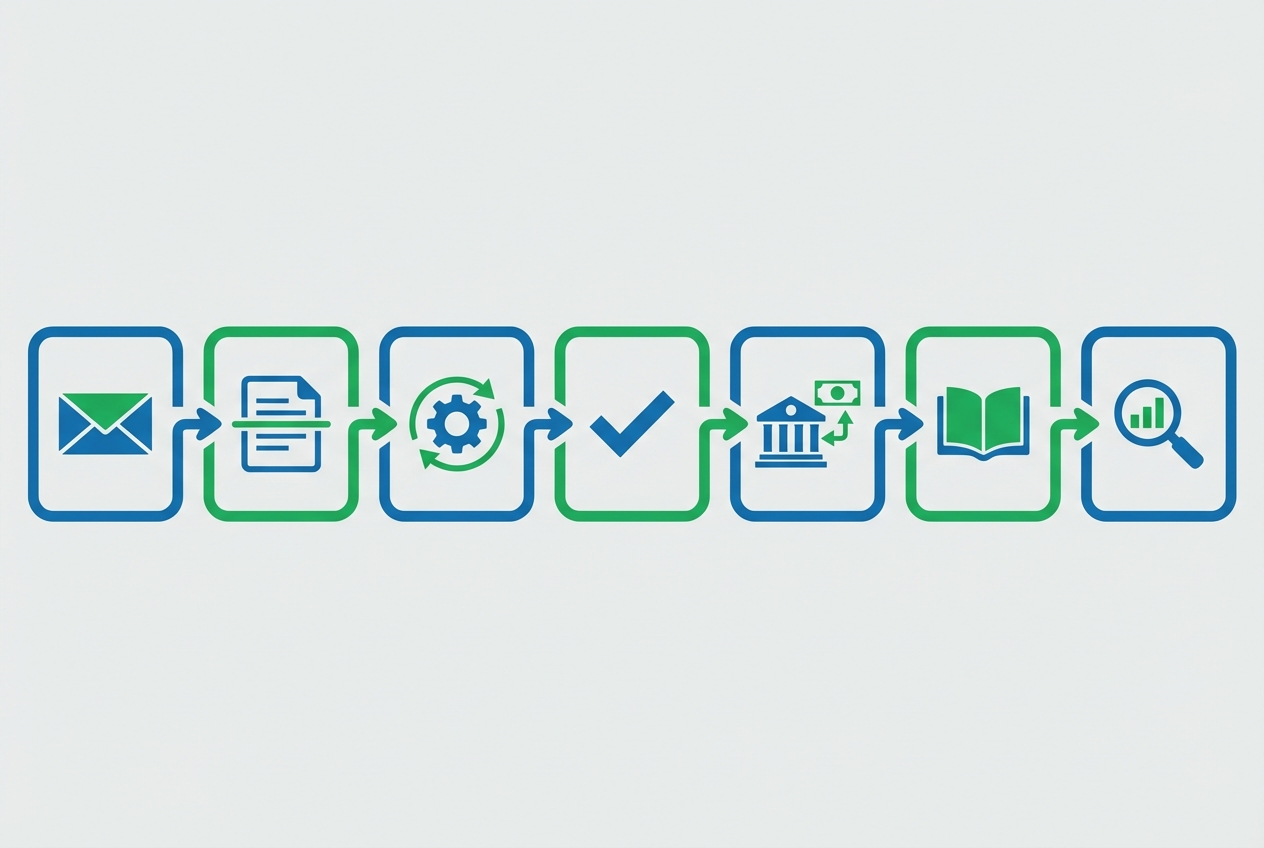

Workflow Diagram: The FAP Automation Path

The "happy path" you want: every invoice becomes structured data, then a rules decision, then controlled payment and clean accounting.

A note worth underlining: automation works best when routine invoices flow through untouched, and your team focuses on exceptions and disputes that need judgment. That is how you scale freight audit without scaling headcount.

Data Sources and Intake Methods for Freight Audit and Payment

If your intake is weak, everything downstream gets expensive. You either accept risk (overpay), or you hire people to babysit data. Modern FAP systems win by making data predictable.

Electronic Data Interchange (EDI): EDI 210 and EDI 214

For many shippers, EDI is still the backbone of reliable, high-volume freight billing data.

-

EDI 210 (Freight Invoice): This is the electronic version of a carrier freight bill. It contains detailed invoice data and line items used for billing and audit.

-

EDI 214 (Shipment Status): This provides shipment status events with timestamps and locations, which is critical for verifying service completion and timing. For many workflows, it is also a practical way to validate whether an accessorial claim is even possible.

Used together, 210 + 214 supports stronger audit decisions. You can validate "what was billed" and also "what happened."

Modern intake: OCR and AI for non-EDI carriers

EDI coverage is rarely 100%. Some regional carriers do not support it. Many brokers and international partners invoice through PDFs or portals.

That is where automated invoice processing becomes the unlock:

-

OCR (optical character recognition): Reads printed text from PDF scans. Helpful, but often brittle when carrier formats vary or scan quality is poor.

-

AI extraction: Uses pattern learning to capture fields even when layouts change. This is what makes long-tail carrier intake workable without constant template maintenance.

What to aim for in your intake layer:

-

High-confidence field capture: Capture identifiers first. This includes PRO, BOL, and invoice number. Then capture ship date, origin, destination, and service level.

-

Charge capture you can audit: Pull base rate, fuel, and accessorials as structured line items. If your system cannot break charges out, your audit engine will miss errors.

-

Duplicate detection early: Catch invoice number collisions and "same charges resent" events before approval. Add secondary checks on PRO and BOL so renumbered duplicates do not slip through.

Supporting data: the proof behind the payment

Your audit engine is only as good as the data you match against. At minimum, ingest and maintain:

-

Rate tables and contract terms: Store lane rates, minimums, discounts, and accessorial rules. Keep fuel index logic and effective dates with clear version history.

-

Routing guides: Track approved carriers by lane, mode, and service level. Document what "out-of-guide" means and who can approve it.

-

POD and appointment data: Save delivery timestamps and appointment confirmations. Add dwell time and exceptions that justify accessorials like detention.

-

Claims and service failure rules: Define late delivery refunds, OS&D, and penalty clauses. Assign ownership so follow-up is not a guessing game.

This is also why exception management matters. When you resolve an exception, you are not just correcting a bill. You are tightening rules, fixing master data, or clarifying contracts so the next invoice is easier.

API integration: real-time TMS context (and why it reduces disputes)

How do you stop arguing with carriers on every exception? You anchor disputes in shared facts.

Real-time API calls to a transportation management system (TMS) can provide the context your invoice alone will never include:

-

Tender acceptance and mode details: Confirms which carrier and service level actually moved the load. This reduces "wrong carrier" disputes.

-

Shipment milestones: Confirms pickup, in-transit, and delivered events. When paired with EDI 214, this becomes a reliable time record.

-

Stops, appointments, and detention triggers: Supports or disproves detention, redelivery, and appointment-related charges with timestamps.

-

Reference integrity: Ensures the invoice ties to the correct shipment record. This protects you from fat-fingered PROs and reused BOLs.

If your TMS is hard to integrate, start with a minimum viable API set: shipment header, stops, reference numbers, and status timeline. Even that can dramatically improve audit outcomes.

To see how Quantum Bytes' TMS typically structures this data, see how we helped our client Avian.

Intake method comparison

| Intake method | Best for | What breaks | What "good" looks like |

|---|---|---|---|

| EDI 210/214 | High-volume carriers and consistent billing | Slow onboarding and partner-by-partner mapping | Stable, structured data with predictable fields |

| Carrier portals | Mid-volume carriers with web billing | Manual exports and inconsistent formats | Automated pulls or scheduled downloads |

| PDF via email | Long-tail carriers and brokers | Layout variation, scans, missing line items | AI extraction, validation, and exception queues |

| API invoices | Modern carriers and platforms | Versioning, auth, incomplete remittance | Event-driven ingestion with strong idempotency |

Building a Freight Audit and Payment System: Practical Controls That Matter

Most overspend is not caused by one big mistake. It is caused by small ones that slip through because controls are weak.

Here are the controls that actually move the needle:

-

Audit rule versioning: Your contracts change. Your audit rules need effective dates too. Without them, you will fail valid invoices and miss invalid ones when terms roll mid-month.

-

Approval thresholds tied to risk: A $50 accessorial should not require the same process as a $50,000 spot move. Route high-risk charges to stricter approvals. High-risk often means a new carrier, a spot quote, or an out-of-guide lane.

-

Duplicate payment prevention: Block payments when invoice number + carrier + amount matches an already-paid record. Add secondary checks on PRO and BOL to catch renumbered duplicates.

-

Payment file governance: Restrict who can generate payment files, who can approve them, and who can release funds. Separate duties so one person cannot create and pay a fraudulent invoice end-to-end.

-

Remittance clarity: Paying is not the finish line. Clear remittance reduces carrier AR churn, short pays, and relationship friction.

Two more controls are often overlooked, and they are worth adding early:

-

Master data discipline: Keep carrier IDs, SCACs, remit-to addresses, bank details, and tax settings consistent across your TMS, audit layer, and ERP. A clean audit can still produce a bad payment when master data is messy.

-

Exception reason codes with feedback loops: Track why invoices fail audit (rate mismatch, unsupported accessorial, duplicate, missing POD). Use that data to fix lane tables and coach carriers. Over time, the exception rate should drop.

For payment execution, many shippers rely on ACH for predictable settlement and cost. Nacha is the governing body for the ACH Network, including business payment formats like CCD and CTX.

If you are designing this flow, build your FAP stack so finance can answer, fast:

-

What did we pay: The paid amount, date, method, and remittance details.

-

Why did we pay it: The rule outcome and approver trail that justify the decision.

-

What contract and proof supported it: The pricing terms, effective dates, and shipment evidence behind the charge.

-

Where did it land in the GL: The cost center, customer, lane, and mode dimensions used for reporting.

If your current tools cannot give you those answers quickly, you are not just missing reporting. You are missing control. This is a common moment to build a small internal "audit cockpit" that pulls exceptions, proof, and approvals into one queue. When you need that cockpit to match your exact process, a custom build is often faster than trying to bend off-the-shelf tools.

Turning FAP Into a Competitive Advantage (Not Just a Back-Office Task)

Once your intake, audit, and payment controls are solid, you can use FAP data to negotiate better and operate with confidence.

What you unlock:

-

Carrier performance transparency: On-time rates, accessorial frequency, and billing accuracy by carrier. You can reward reliable partners and fix chronic issues.

-

Contract leverage: You can renegotiate with evidence, not anecdotes. This includes which accessorials spike, and which lanes drift from the rate card.

-

Accrual accuracy: Month-end close stops being a scramble because expected spend is tied to shipment truth. It is not tied to late-arriving invoices.

-

Service cost visibility: You can price customer delivery promises with real cost data, not averages. This protects margin on expedited or white-glove services.

-

Faster dispute cycles: With linked proof (status events, appointments, POD), your team can resolve exceptions quickly and keep carrier relationships stable.

To keep the system honest, track a small set of FAP health metrics. Do it weekly at first:

-

Audit hit rate: The share of invoices that pass cleanly on the first run. This tells you whether your contracts and master data are usable.

-

Exception aging: The average days an exception sits unresolved. This is where cash flow and carrier trust go to die.

-

Recovery rate: Dollars recovered from overbilling as a share of total spend. Watch this trend over time. Early wins should turn into prevention.

-

Duplicate block count: How many duplicates were prevented. If this is zero, you are likely missing them.

This is also where custom software becomes a force multiplier. Many teams start with a third-party freight audit provider, then hit limits around niche workflows, custom reporting, or integrating with a legacy ERP.

If you want to test a custom workflow quickly, build a thin prototype first: intake → normalize → audit rules → exception queue. Quantum Byte’s approach is designed for that style of build. You get an AI-powered app builder plus an in-house dev team when you need deeper integrations or tighter controls.

Wrap-up: What a Modern Freight Audit and Payment System Should Deliver

Freight audit and payment works when it becomes a system, not a monthly fire drill. This guide covered:

-

The end-to-end FAP lifecycle: From invoice intake through GL posting, with clear handoffs and controls.

-

The core automation path: Normalize data, apply audit rules, route exceptions, control approvals, execute payment, then report.

-

The intake methods that matter most: From EDI 210/214 to AI-based extraction for PDFs and portals.

-

The supporting data and API integrations: The inputs that turn billing review into real audit accuracy and faster dispute resolution.

-

The financial controls that protect cash: Duplicate prevention, payment governance, remittance quality, and clean accruals.

-

The management layer that keeps it improving: Metrics like audit hit rate and exception aging, so the process gets tighter over time.

If you are serious about lowering transportation spend without adding headcount, your next step is straightforward: pick one mode (LTL, FTL, parcel, ocean), build a clean intake pipeline, and enforce a small set of high-impact rules. Then expand.

For shippers that need speed without sacrificing control, a custom FAP layer can bridge legacy TMS data and modern accounting requirements in days, not months.