Fuel price volatility is one of the most unpredictable variables in logistics. Diesel prices can swing hard within a single quarter, and that volatility shows up on every invoice you pay.

For transportation managers, the fuel surcharge (FSC) is the risk-sharing mechanism that keeps carriers moving and shipper budgets defensible. But it is also one of the most common sources of billing errors, disputes, and quiet overspending. Industry teams that invest in automation often find meaningful leakage. For example, transportation spend management automation can surface discrepancies in a notable share of invoices, especially where index timing and carrier-specific matrices are involved.

This guide breaks down fuel surcharge calculation for shippers, analysts, and AP professionals. It focuses on the formulas, index sources like the EIA, and the contract parameters you need to validate every billed dollar. You will also see what it takes to move from manual spot-checks to an automated FSC audit workflow.

The Fundamentals of Fuel Surcharge Calculation for Shippers

For shippers, the fuel surcharge does more than add a line item to an invoice. It codifies how you and your carrier share fuel risk as prices move up or down.

That means validating FSC starts with contract parameters, not the carrier's total on the invoice. Unlike base freight rates, which are often negotiated and then held steady for a period, FSC changes week to week (and sometimes lane to lane). Your job is to ensure the carrier used the right index, at the right time, with the right trigger and formula.

A practical rule: your AP team should always validate the effective date of the fuel index used. Many U.S. domestic contracts reference the weekly EIA U.S. On-Highway Diesel Fuel Price. But the effective period must be crystal clear in your contract (for example, "Tuesday through Monday, based on Monday's EIA posting"). If your contract is vague, you invite "index shopping," where the billed week is chosen because it benefits the carrier.

At small volume, you can catch this with a spreadsheet and a sharp analyst. At scale, it becomes a workflow problem. Building these checks into your AP process is where automation pays off, especially when it connects to your broader accounts payable automation stack.

Standard Fuel Surcharge Formulas and Required Inputs

To compute an accurate fuel surcharge, you need four primary inputs:

-

Current index price: The fuel price from the exact index source and effective week your contract defines.

-

Base fuel price (also called peg): The fuel price built into the base rate, where surcharge starts at zero.

-

Fuel efficiency factor (MPG) or matrix logic: The agreed consumption assumption (for per-mile) or the carrier's published price-band table (for percentage-based).

-

Distance (miles) or linehaul amount: What the formula is applied to.

Your calculation will usually fall into one of two families: per-mile (common in truckload) or percentage-of-linehaul (common in LTL).

Per-Mile FSC (The Truckload Standard)

Most Full Truckload (FTL) carriers use a per-mile surcharge. Shippers like it because it is transparent and directly tied to assumed consumption.

Formula:

((Current Fuel Price - Base Fuel Price) / Average MPG) = FSC per Mile

FSC per Mile x Total Miles = Total Fuel Surcharge

Key contract inputs to verify:

-

Base fuel price: The peg where FSC is zero. Older contracts often have lower pegs like $1.20 or $2.00. Newer agreements may push higher.

-

MPG factor: Often 6.0 to 6.5 MPG. Some fleets negotiate different MPG targets based on equipment, terrain, or operating profile.

What causes problems in real life is not the math. It is the inputs. A carrier using the wrong week's index, applying a different regional index than negotiated, or billing miles that do not match your tendered route will all distort the result.

Percentage-of-Linehaul FSC (The LTL Standard)

Less-than-Truckload (LTL) carriers typically use a percentage-based model because a trailer holds freight from many customers.

Formula:

Base Freight Rate x Surcharge Percentage (%) = Total Fuel Surcharge

Instead of a single "MPG," the carrier publishes a matrix. Each fuel price band (often in $0.05 or $0.10 increments) maps to a surcharge percentage.

The audit requirement is simple to say and easy to get wrong: you must map the correct index price to the correct band in that carrier's specific matrix, for the correct effective period. If your invoice workflow cannot reliably do that, FSC becomes a "trust me" charge.

This is one place where integrating rules directly into an automated invoice pipeline matters. If you are already improving speed and accuracy with invoice automation, FSC validation is a natural next step.

Key Factors: Indices, Triggers, and Price Bands

Fuel surcharge disputes usually come down to three contract mechanics that sound small, but drive real dollars.

-

Index sources: Your contract must name the index. Many U.S. contracts use the EIA weekly index. Some regional or specialized lanes use localized products such as OPIS (Oil Price Information Service). If the index is not explicit, you will spend time arguing about whose "truth" is correct.

-

The trigger: The trigger is the price point where the surcharge begins. If diesel is $3.40 and your trigger is $3.50, the billed FSC should be $0.00 (or the matrix band should be at the no-surcharge level). Triggers protect shippers when fuel drops.

-

Price bands: Bands are the step increments in a matrix (percentage-of-linehaul) or the step logic in a per-mile schedule. For example, every $0.10 increase above the base might increase FSC by $0.01 per mile. Your audit needs to follow the carrier's banding rules exactly, not "close enough."

Mode-Specific FSC Variations and Lane Differences

Fuel surcharge calculation is not one-size-fits-all. Mode and geography change what "correct" looks like.

-

Truckload (TL): Usually per-mile. Contracts may reference the national average or a regional value (such as PADD-based pricing). If you ship across multiple regions, make sure your lane rules specify when regional indexing applies.

-

LTL: Nearly always percentage-based, using a carrier matrix. Watch for floor percentages that persist even if fuel drops. If the contract allows a minimum, your model should reflect it so you do not flag valid invoices by mistake.

-

Intermodal and ocean: These often use a Bunker Adjustment Factor (BAF) or mode-specific indices with a lag (commonly 30 to 90 days). If you audit these like truckload, you will get false exceptions. The effective period and lag mechanism must be part of the rule set.

-

Lane differences: A shipment in a high-cost region can justify a higher surcharge than a low-cost region, even in the same week. If you pay national averages on lanes that should be regional, you can overpay quietly for months.

If you want a single source of truth for these rules, your TMS and finance workflow should agree on the same lane logic. See how we helped Avian mordernize their TMS .

Comprehensive FSC Calculation Example

Below is a sample showing how a $3.50 current price interacts with different contract terms.

| Item | Scenario A (Per Mile) | Scenario B (Percentage) |

|---|---|---|

| Current Index Price | $3.50 | $3.50 |

| Base Fuel Price | $2.50 | $2.00 |

| Trigger / MPG | 6.5 MPG | 15% at $3.50 Price Band |

| Shipment Distance/Rate | 500 Miles | $1,200 Linehaul |

| Computed FSC Rate | $0.154 per mile | 15% of rate |

| Total Surcharge | $77.00 | $180.00 |

Two takeaways matter for audits:

- Different contract structures can produce very different FSC totals for the same week's diesel price.

- You cannot "eyeball" whether a surcharge is reasonable. You must recompute it using the exact contract inputs.

Automating FSC Validation with Quantum Byte

An FSC audit is a repeatable workflow, not a monthly scramble.

An FSC audit is a repeatable workflow, not a monthly scramble.

Manual FSC auditing is prone to leakage. Even strong teams miss issues when volume spikes or when carriers change their effective weeks. Common failure modes include:

-

The wrong week's index used: Timing mismatches are common when contracts define a specific effective window (like Tuesday to Monday), but invoices default to a different week.

-

The wrong index used: National vs regional indexing, or a different vendor source, can change the surcharge even if the formula is "right."

-

A negotiated base price not applied: This is one of the fastest ways to overpay quietly, especially after carrier contract renewals.

-

An LTL matrix band mis-mapped: If the matrix changes and your rule set does not, the billed percentage can drift away from the contract.

Quantum Byte is a fit when you want to turn that messy, repetitive work into a system. While the math is straightforward, the primary value lies in enforcing your contract logic consistently, invoice after invoice, across carriers and modes.

In practice, automation pairs well with machine-readable invoice feeds. For example, many carriers transmit invoice details via EDI. The official ANSI ASC X12 reference for the Motor Carrier Freight Details and Invoice transaction set is the X12 210 transaction set. If you already receive EDI 210 or structured invoice data, you have the raw material needed for automated validation.

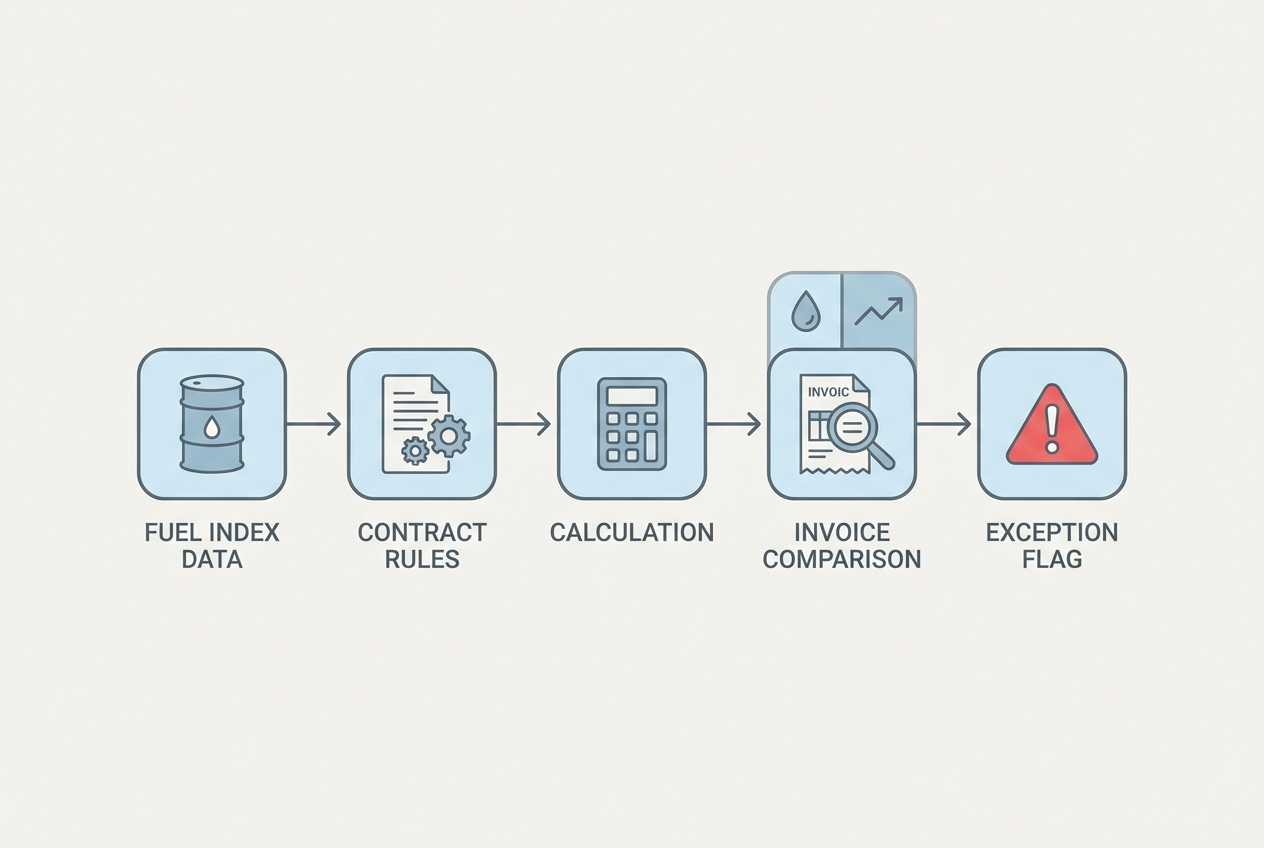

The FSC Audit Workflow

- Pull index: Automatically fetch the weekly index (for example, the EIA weekly diesel price) on the contract-defined cadence.

- Select contract rules: Identify the base price, trigger, MPG target, and index region or matrix for the carrier and lane.

- Compute expected FSC: Apply the correct formula to the shipment miles or linehaul amount.

- Compare to billed: Match the expected FSC against the invoice line item.

- Route exceptions: If the discrepancy exceeds a tolerance (commonly 1%), flag it for review and dispute.

This is also where you can stack controls. Teams that validate FSC often discover other invoice issues at the same time, such as duplicate charges. Adding a second layer like duplicate invoice detection helps ensure you do not pay the same surcharge twice.

Calculator Logic Pseudocode

def calculate_fsc(billed_amount, miles, current_index, base_price, mpg_target):

# Standard Truckload Formula

expected_rate_per_mile = (current_index - base_price) / mpg_target

expected_total_fsc = miles * expected_rate_per_mile

# Validation Logic

tolerance = 0.01 # 1% error margin

if abs(billed_amount - expected_total_fsc) > (expected_total_fsc * tolerance):

return "EXCEPTION_FLAGGED"

return "VALIDATED"

If you want to pressure-test what this would look like for your lanes and carrier mix, Quantum Byte's AI app builder is designed for workflows like this, where rules, data sources, and approvals need to work together without months of build time.

Wrap-up: Strategic Logistics Spend Management

Fuel surcharge calculation rewards precision. When your team treats FSC as a contract-controlled charge with defined inputs and repeatable math, you stop "good enough" invoices from slipping through.

In this guide, you covered:

-

FSC models: The two dominant models include per-mile (common in truckload) and percentage-of-linehaul (common in LTL).

-

Contract mechanics that drive errors: Indices, triggers, and price bands are small details that can create big billing mismatches if they are not enforced.

-

Mode and lane variation: Geography and mode change what "correct" looks like, especially when regional indices or lagging bunker factors apply.

-

A reusable calculation example: A concrete, side-by-side scenario helps you validate invoices instead of guessing.

-

An automation blueprint: A repeatable audit workflow using structured invoice data and contract rules reduces leakage and speeds up dispute routing.

Modernizing your logistics stack, from your TMS to your ERP, allows for cleaner data, faster approvals, and fewer disputes. If your team is still spot-checking FSC manually, the fastest path to savings is not a bigger spreadsheet. It is a workflow that runs every time, for every invoice, with exceptions routed to the right person before payment.

Frequently Asked Questions

How is fuel surcharge calculated in trucking?

It is typically calculated as (Current Index Price - Base Price) / MPG for truckload, or as a percentage of the total freight rate for LTL shipments using a carrier matrix. Automation helps by consistently applying the correct index week and contract rules across every invoice.

What is a normal fuel surcharge percentage?

It varies by mode, carrier matrix, and diesel price level. In LTL, fuel surcharge percentages often fall in a wide range (commonly around 15% to 40% of linehaul during volatile periods), but there is no universal "normal." The only defensible benchmark is your contract's price bands mapped to the weekly index.

Who sets the fuel surcharge rates?

Fuel surcharge rates are negotiated privately between shippers and carriers. Many agreements reference public indices, such as the weekly EIA U.S. On-Highway Diesel Fuel Price, as the factual basis for the calculation.

What is the base fuel price in a contract?

The base fuel price is the starting point where the surcharge is zero. Any index price above that base triggers FSC. Because the base price directly affects the surcharge, it is a key negotiation lever and a key audit input.

How can I automate my fuel surcharge audit?

You automate it by turning your contract into explicit rules (index source, effective week, trigger, MPG or matrix), then applying those rules to invoice data at scale. If you receive structured invoices such as EDI, the X12 210 transaction set provides a standard format that can support automated validation and exception routing.