With freight brokerage margins for small-to-mid-sized firms often dipping below 15% due to capacity oversupply, operational efficiency is no longer optional. In 2026, the right transportation management system (TMS) acts as the central nervous system for a brokerage, turning manual data entry into automated profit centers.

This guide breaks down the top TMS software for freight brokers, evaluating them on scalability, integration capabilities, and practical ROI. Whether you are a startup broker looking for a low-risk entry point or an established 3PL pushing for enterprise-grade automation, understanding the landscape is the first step toward reclaiming your margins.

What to Look for in TMS Software for Freight Brokers

The "best" TMS for a freight broker focuses on removing time from every load rather than simply offering the longest feature list. That means quoting, booking, covering, tracking, billing, and paying all move faster with fewer touch points.

Here is what matters most in 2026.

- Broker-first automation: A broker lives in exceptions. Your TMS should still automate the 80% so your team can focus on the 20% that needs judgment. Look for automated load creation, carrier selection workflows, templated emails, and invoice capture.

- Speed (time per order): Modern systems aim to shrink the full order lifecycle. In strong implementations, brokers can cut the time spent per order dramatically.

- Digital freight matching: This is the layer that helps your team cover loads faster. The best platforms either have matching built in or connect tightly to your load board and carrier network so your reps spend less time searching and more time booking.

- Integration ecosystem: A TMS is only as good as its connections. You want proven integrations for:

- Load boards: DAT, Truckstop, and private carrier networks.

- Tracking: GPS, ELD-derived tracking providers, and shipper-facing tracking pages.

- Accounting: QuickBooks (common for small brokerages), plus more robust accounting stacks for multi-entity operations.

- E-sign + docs: BOLs, PODs, rate confirmations, and claims documentation.

- Scalability without friction: Cloud-based TMS platforms generally win here. You should be able to add users, branches, and customers without buying servers, scheduling downtime, or rebuilding your process every quarter.

- Workflow fit, not just features: If your brokerage does specialized work (reefer, hazmat, project freight, high-touch white glove), validate the exact operational flow in a demo. Most pain comes from small gaps: accessorial handling, appointment workflows, detention logic, or customer-specific billing rules.

Top 7 TMS Software Platforms for Freight Brokers in 2026

There is no universal winner. There is only the best fit for your current stage and your next stage.

Quick comparison table

| TMS Platform | Best for | Strengths | Watch-outs |

|---|---|---|---|

| AscendTMS | New brokers and lean teams | Fast setup, approachable UI, strong starting point | You may outgrow it if you need deep automation across departments |

| Rose Rocket | Modern brokerages that want a strong shipper/carrier experience | Portal-driven collaboration, clean workflows | Premium features can push you toward higher tiers sooner |

| Alvys | Teams that want an "operations + accounting" rhythm in one place | Strong end-to-end flow, payments support | Validate integrations if you rely on a specific niche tool |

| DAT Broker TMS | Brokers who live in DAT and want tight workflow continuity | Native DAT ecosystem fit, robust accounting | Best value if your team already runs heavy DAT volume |

| Tai Software | Scaling brokerages with repeatable processes across LTL and FTL | Automation depth, high-throughput workflow design | Implementation discipline matters, plan for change management |

| Descartes Aljex | 3PLs that prioritize reliability and tendering workflows | Stable operations, broad logistics footprint | UI may feel less "modern" depending on your team's expectations |

| Turvo | High-touch, visibility-heavy freight programs | Collaboration and visibility, stakeholder alignment | Make sure your ops team wants the collaboration-first model |

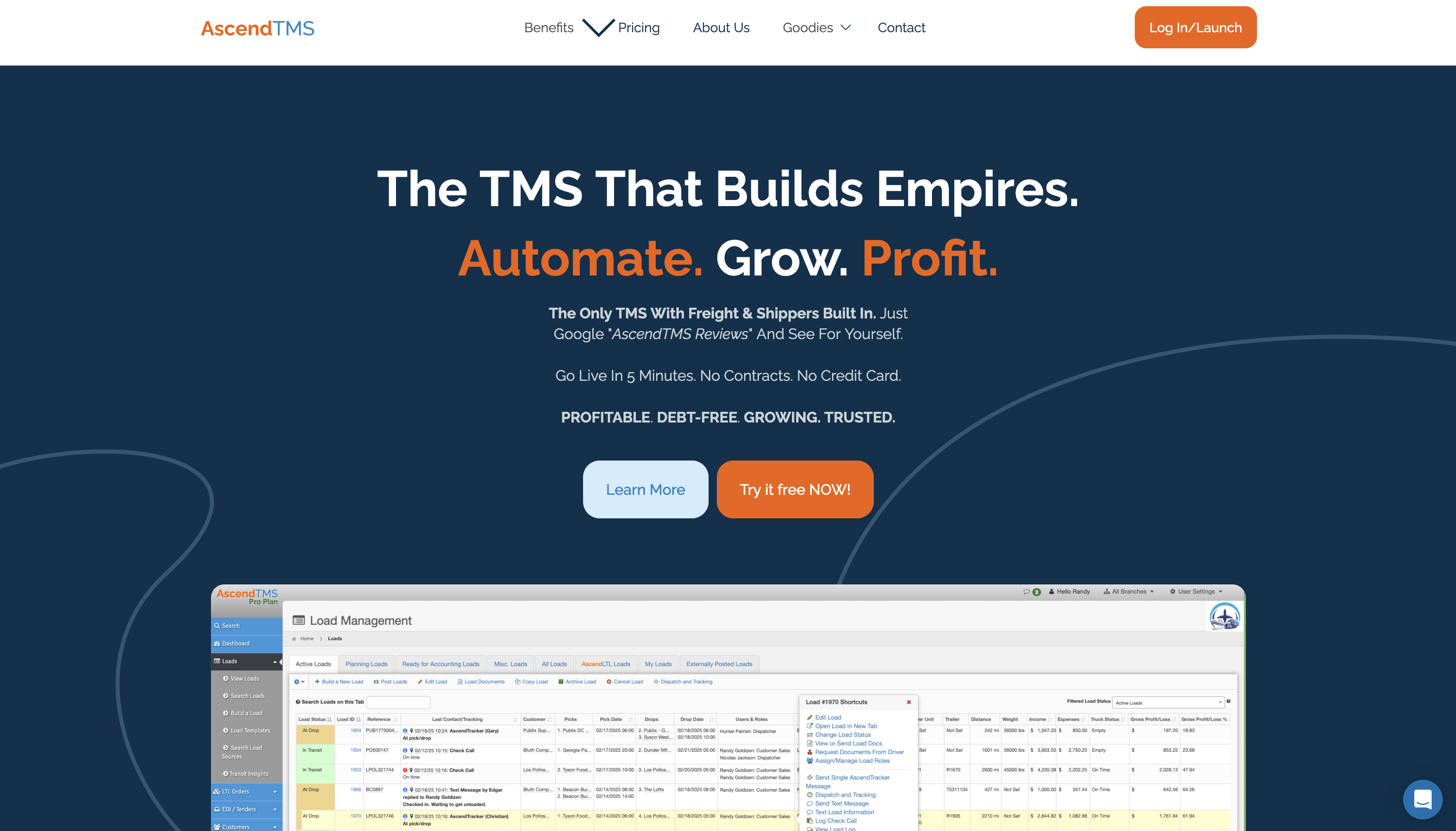

1) AscendTMS

AscendTMS is frequently shortlisted by startups because it offers a "free" tier and covers the basics without a steep learning curve. In practice, that means you can start organizing loads, carriers, and customer records quickly, then expand as volume grows.

- Best fit if: You are launching a brokerage, you need structure fast, and you want a TMS that your team can learn without weeks of training.

- What to validate in a demo: How you will handle growth: multi-user permissions, standardized templates, and your tracking + accounting workflow.

- Learn more: AscendTMS official website

2) Rose Rocket

Rose Rocket leans into a "Network TMS" approach: brokers, carriers, and shippers collaborate through modern portals. This is especially useful when your customers demand transparency and when your ops team is tired of copying updates into emails all day.

- Best fit if: Your growth depends on a premium shipper experience: self-serve visibility, quick document exchange, and smoother communication.

- What to validate in a demo: The exact portal experience for each persona (shipper vs carrier) and how exceptions are handled.

- Learn more: Rose Rocket official website

3) Alvys

Alvys has built a reputation around high user satisfaction and tight coverage from sourcing to accounting and payments. For many brokerages, that "one rhythm" matters more than any single feature.

- Best fit if: You want fewer handoffs between systems and a clearer lane from booked load to paid invoice.

- What to validate in a demo: Your settlement workflow, how accessorials are captured, and how payment timing affects cash flow.

- Learn more: Alvys official website

4) DAT Broker TMS

DAT Broker TMS is a strong option when your brokerage already lives inside DAT for carrier capacity and pricing signals. The appeal is continuity: fewer clicks and fewer copy-paste moments between load board and TMS.

It also stands out for its accounting capabilities, which matters when you want a TMS to function as an operational system and a financial control system.

- Best fit if: DAT is central to how your team covers freight and you want a tight, native workflow.

- Learn more: DAT Broker TMS official website

5) Tai Software

Tai Software is known for heavy automation across the LTL and FTL lifecycle and is often associated with high-throughput broker operations. If your goal is to increase shipment volume without increasing headcount at the same pace, this category of TMS can be a force multiplier.

- Best fit if: You have repeatable lanes and repeatable processes, and you want to scale with disciplined automation.

- What to validate in a demo: How rules-based automation is configured, and how quickly you can change workflows without vendor intervention.

- Learn more: Tai Software official website

6) Descartes Aljex

Descartes Aljex is commonly positioned for 3PLs and brokerages that value reliability, broad integration options, and automated tendering. For many teams, stability is a feature, especially when loads cannot wait for a brittle workflow to recover.

- Best fit if: You are a 3PL or established brokerage that needs a dependable operational backbone.

- What to validate in a demo: Tendering automation, EDI needs, and how visibility and customer communications are handled.

- Learn more: Descartes Aljex official website

7) Turvo

Turvo emphasizes "collaborative logistics." That matters when you run premium freight where customers expect real-time visibility, shared workflows, and clean handoffs.

- Best fit if: You manage high-touch freight programs and want customers to feel like they are inside the process, not outside of it.

- What to validate in a demo: Visibility accuracy, alerting, and how customers interact with updates and documents.

- Learn more: Turvo official website

How Modern TMS Software Drives Freight Brokerage ROI

A TMS should pay for itself. Not in theory. In your weekly operations.

Here are the ROI levers that consistently move results for brokers.

- Direct cost savings: A well-implemented TMS can deliver measured ROI in the range of 2% to 15% from optimization capabilities alone, depending on how much workflow standardization and automation you actually adopt.

- Error reduction: When you stop re-keying the same load data across systems, errors drop. Automating order processing can reduce error rates by more than 90%, which directly lowers billing disputes, rework, and claims overhead.

- Back-office efficiency: In many brokerages, billing is the bottleneck that quietly kills cash flow. Invoice automation speeds up billing, reduces missing documents, and makes collections cleaner.

- Timeline for success: Most companies realize a full return on their TMS investment within 6 to 18 months when adoption is real and processes are standardized.

A practical note: ROI depends on whether your team runs the same playbook on every load as much as it depends on the platform. The TMS makes that playbook enforceable.

Essential Features to Automate Your Freight Operations

If you want more margin without squeezing carriers or losing shippers, you need automation that reduces labor per load and improves service consistency.

These features tend to create the biggest compounding gains.

- Automated carrier onboarding: Reducing fraud risk and ensuring compliance without manual document chasing. The best setups centralize COIs, W-9s, authority checks, and safety documentation, then flag exceptions for review.

- Real-time visibility: Integrate GPS and ELD-derived tracking so shippers get automated tracking links. When customers can self-serve updates, "check calls" drop, and your team regains hours per week.

- Advanced analytics: Use lane and carrier data to see what is actually profitable. This is how you stop guessing and start steering.

- What to look for: Profit by lane, profit by customer, carrier scorecards, tender acceptance trends, and dwell time patterns.

- Why it matters: You cannot protect margins you cannot measure.

- Related example: See how Avian used a TMS to improve their operations.

- Financial automation: Settlement and payables are where brokerages either become disciplined or become stressed. Automating approvals, matching, and payment scheduling helps you pay carriers on time while keeping cash flow predictable.

If your TMS cannot cover one of these areas well, you can sometimes fill the gap with integrations. But every extra tool adds cost and complexity. Aim for a setup your team can run without heroics.

Custom vs. Off-the-Shelf: Scaling Your Brokerage

Most brokerages should start with off-the-shelf SaaS. It gets you running quickly, and it pushes you toward standard workflows. That is a good thing early on.

But "buy" is not the end of the story. It is the starting line.

The build vs. buy dilemma

You should consider custom work when your competitive advantage depends on a workflow that off-the-shelf tools keep fighting.

Examples include:

- Unique quoting logic: Customer-specific pricing models, bundled accessorial rules, or margin guardrails that must run automatically.

- Specialized compliance: Refrigerated, hazmat, or other niche constraints that require deeper checks and documentation flows.

- Multi-system orchestration: When your TMS, CRM, accounting, and customer portal are all "almost" connected, and your team becomes the integration layer.

If you want a clear framework, check out our build vs buy guide.

Where Quantum Byte fits (without replacing your TMS)

There is a practical middle path that many growing brokerages miss: keep your core TMS, and build the custom layer around it.

Quantum Byte is designed for that kind of work. You can prototype internal tools from natural language, then have an in-house development team connect the pieces that AI tools cannot handle yet. The result is usually a set of small, high-impact apps that remove your biggest bottlenecks rather than a completely custom TMS. Think intake forms, exception workflows, customer portals, document chasing, or margin dashboards.

If you want to explore what that looks like for your operation, start by using our ai app builder

Selecting the Right Path for Your Brokerage

The best TMS software for freight brokers depends on your volume today and the business you are building next.

Use this selection lens:

- If you are early-stage: Optimize for speed to implement, low training burden, and core coverage. A simple system that your team actually uses beats a powerful system that collects dust.

- If you are scaling fast: Optimize for automation depth, consistent workflows, and strong integrations. Operational chaos is a greater risk as you scale than feature gaps.

- If you are high-touch or niche: Optimize for visibility, exception handling, and customer experience. This is how you justify premium service and keep accounts.

Practical next steps:

- Demo at least three systems: Start with a short list from the platforms above so you have real comparisons, not just marketing claims.

- Bring real load scenarios into the demo: Include a clean FTL, an LTL with accessorials, a late pickup, a claim, and a rate dispute so you can see how exceptions behave.

- Run a pilot: Test with a small team before full rollout so you can tighten workflows without disrupting the whole operation.

- Measure baseline metrics: Track time to cover, billing cycle time, error rate, and margin by lane so ROI becomes visible instead of assumed.

And if you discover your biggest constraint is not "which TMS" but "how your tools connect," that is the moment to consider a custom layer. Quantum Byte can help you turn that friction into a scalable system in days, not months, by building targeted apps around your existing stack. Get started just with a spec of what you want

The Bottom Line for 2026

In the current freight market, a broker cannot protect margins with effort alone. You need systems that make speed and consistency the default.

This guide covered what makes a TMS "best" for a freight broker, the seven platforms that lead most shortlists in 2026, and the specific features that drive ROI through automation, fewer errors, and faster cash collection. You also saw when off-the-shelf SaaS is the right move and when a custom layer becomes the simplest way to unlock the next stage of growth.

Pick the platform that your team will actually run every day, then build your process discipline around it. That is how you turn brokerage chaos into a scalable operation.