If you are asking what type of apps make the most money, you are really asking a sharper question: "Which apps create the most reliable, repeatable cash flow?" The answer hinges on retention, pricing power, and a distribution path you can actually win. A flashy idea can help, but it rarely carries the business on its own.

Here is the most useful headline: the apps that tend to earn the most are the ones tied to an ongoing outcome (subscription) or a real-world transaction (take rate), aimed at a specific audience with a painful problem.

What type of apps make the most money

The highest-earning app businesses usually fall into a few repeatable patterns.

-

B2B workflow apps (vertical SaaS): These apps automate work that costs a business time or payroll. Buyers pay because the app saves money or helps them make more.

-

Subscription consumer apps with strong retention: Fitness, learning, productivity, and creator tools can do well when they build daily or weekly habits.

-

Marketplaces with a take rate: If your app helps buyers and sellers complete a transaction, you can earn a percentage of every sale.

-

Fintech apps that attach to money movement: Budgeting, invoicing, and compliance are "boring" problems, but they often have real willingness to pay.

-

B2B data and reporting products: Dashboards, scorecards, and compliance reporting sell because they reduce risk and make decisions faster.

A simple way to spot "money apps" is to look for problems where your user already pays today (with tools, staff, or messy spreadsheets).

The profitability drivers that matter more than the category

You can build the "right" category and still struggle if you miss the fundamentals. These are the levers that make an app profitable.

-

Strong willingness to pay: People pay when the problem is expensive, urgent, or tied to revenue.

-

High frequency of use: Apps that become part of a routine keep customers longer, which makes paid acquisition safer.

-

Clear ROI (return on investment): If you can say "this replaces X hours" or "this reduces errors," selling gets easier.

-

Low marginal cost: Software scales because serving the next customer is cheap. But only if support, onboarding, and compliance do not explode.

-

Distribution that matches your strengths: If you have an audience, business-to-consumer (B2C) can work. If you have a niche network, business-to-business (B2B) can be faster.

The app types that are consistently profitable (with best-fit monetization)

The list below is designed for founders who want repeatable upside, not lottery tickets.

| App type | Why it can make serious money | Best-fit monetization | Good fit if you… |

|---|---|---|---|

| Vertical SaaS for a niche (e.g., clinics, contractors, agencies) | Clear pain, clear buyer, and higher pricing power than broad tools | Subscription (tiered), per-seat pricing | Already understand one industry and its workflows |

| Internal ops automation app (for a specific role) | Replaces manual admin, reduces mistakes, and speeds delivery | Subscription, per-workflow or per-seat | Hear the same "we do this in spreadsheets" complaint everywhere |

| Marketplace (matching supply and demand) | You earn on every transaction once liquidity exists | Take rate, listing fees, escrow, lead fees | Can seed supply or demand through a niche community |

| Fintech workflow (invoicing, reconciliation, compliance) | Money workflows are sticky and risk-sensitive | Subscription, usage-based, premium support | Can integrate with existing tools and keep the user experience (UX) simple |

| Habit-driven consumer app (fitness, learning, focus) | Retention can be strong when the habit is real | Subscription, freemium upgrade | Can create content, coaching, or community that drives daily use |

| B2B analytics and reporting | Decision support is valuable, especially in regulated industries | Subscription, per-dashboard, per-data source | Can connect messy data and make it understandable |

If you want examples to spark ideas, QuantumByte has a strong roundup of apps earning meaningful monthly revenue and a deeper breakdown of what separates "home run" apps from small side projects.

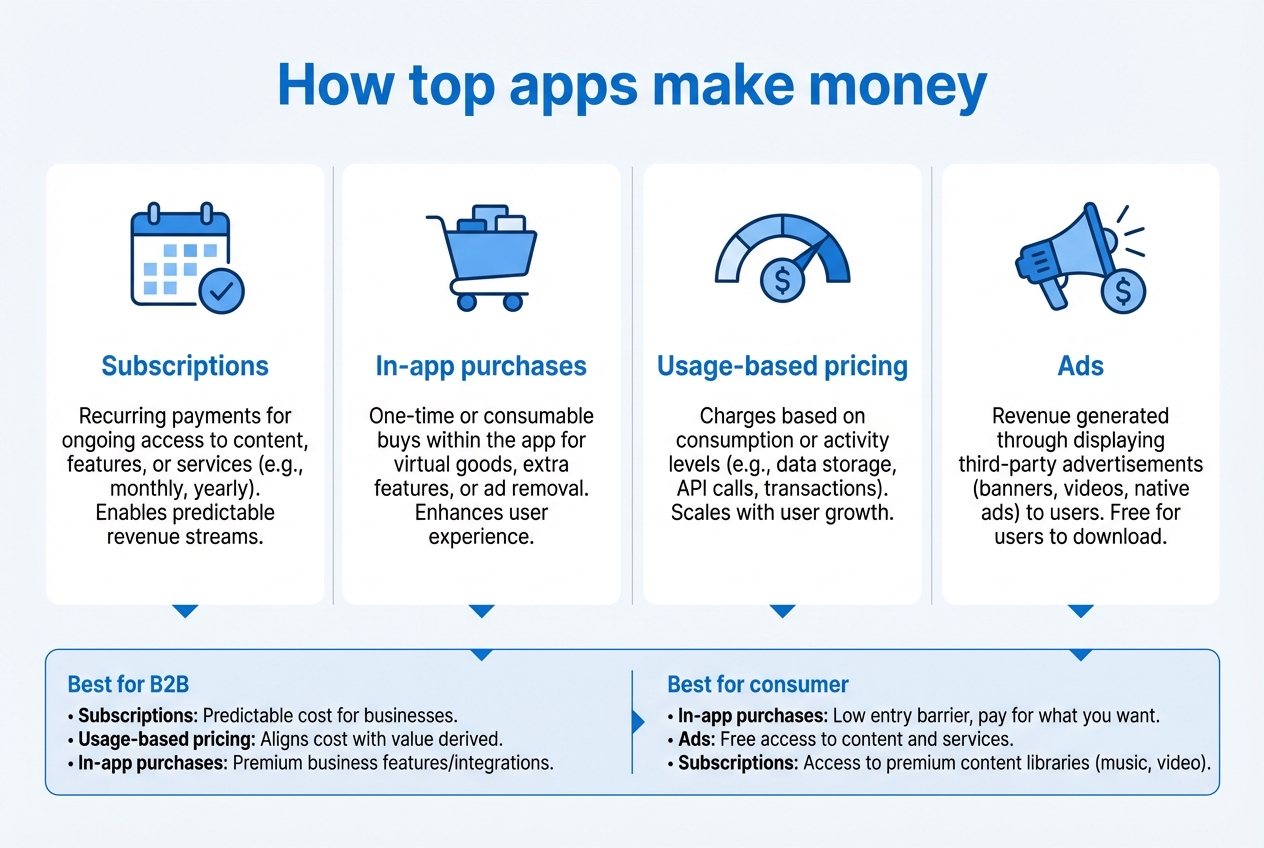

The monetization models that win (and when to use each)

The most profitable apps usually rely on compounding revenue, and recurring billing is often the cleanest way to get it. Here are the models to consider.

The most profitable apps usually rely on compounding revenue, and recurring billing is often the cleanest way to get it. Here are the models to consider.

-

Subscriptions: Best when your app delivers ongoing value (tracking, coaching, workflow automation, reporting). If you sell on iOS, Apple’s subscription docs are worth reading because they shape how you package plans and upgrades (Apple subscriptions).

-

In-app purchases (IAP): Best for unlocking features, content, or digital goods. Apple breaks IAP into consumables, non-consumables, and subscription types, which is helpful for planning your offer (Apple In-App Purchase).

-

Usage-based pricing: Best when value scales with activity (messages sent, invoices processed, calls transcribed). It aligns price with outcome, but you must communicate it clearly.

-

Transaction fees (take rate): Best for marketplaces and payment flows. The challenge is building supply and demand at the same time.

-

Ads: Best when you have massive volume and short sessions. It can work, but it usually forces you into a scale game.

If you plan to sell digital products on Android, Google’s overview of the billing system gives you the practical constraints early (Google Play billing).

A simple framework to choose your “most profitable” app idea

Use this to avoid building something that feels exciting but never sells.

-

Pick a buyer with a budget: A niche business role beats "everyone." Example: "independent dental clinics" beats "small businesses."

-

Write down the recurring pain: If the pain happens once a year, you will fight churn. Weekly pain is better.

-

Find the existing workaround: Spreadsheets, email chains, and manual data entry are your clues.

-

Tie the value to money: Time saved, errors avoided, faster delivery, fewer refunds, higher close rate.

-

Choose a monetization model that matches value: Ongoing outcome equals subscription. Per-transaction value equals take rate. Variable intensity equals usage-based.

-

Plan distribution before you build: Your idea is only as good as the path to your first 50 users.

If you want a deeper walkthrough on monetization design, keep this bookmarked: app monetization strategies with real examples.

High-margin app ideas you can build without a massive team

These ideas are profitable because they reduce chaos for a specific group and can be sold repeatedly.

-

Client portal for a service business: A secure place for uploads, approvals, progress tracking, and invoices.

-

Booking + intake + follow-up automation: For clinics, coaches, home services, and consultants.

-

Proposal and scope builder: Turn discovery calls into consistent statements of work (SOWs) and timelines.

-

Compliance checklist manager: For industries that must prove steps were completed.

-

Operations dashboard for an owner: Pull key numbers into one view so decisions happen faster.

-

White-label app platform for agencies: Build once, sell many times by letting others brand it. If that model fits your vision, the white label app builder guide is a strong next read.

Where most founders lose money

These pitfalls are why many "good" apps never become profitable.

-

Building for yourself instead of a market: Your own pain can spark an idea, but you still need proof from the market. Validate with paid pilots.

-

Shipping features before pricing: If nobody will pay, features do not fix it. Price early, even if it is simple.

-

Trying to win on breadth: Broad apps compete with incumbents. Narrow apps win by being the default tool for one workflow.

-

Ignoring onboarding: Profit dies when users churn in week one. Build setup flows, templates, and "first win" moments.

-

Overbuilding the first version: Make the first release prove the value. Save edge cases for later once the core workflow works.

How to validate a money-making app idea in 7 days

You do not need a 6-month build to find out if the idea can pay you back.

-

Write a one-page offer: Who it is for, the outcome, the before-and-after.

-

Pick one core workflow: The smallest version that still produces value.

-

Pre-sell to 5 to 10 target users: Aim for deposits or signed letters of intent.

-

Prototype the UX (user experience): A clickable prototype is enough to test the flow.

-

Build the MVP (minimum viable product): One workflow, one audience, one job-to-be-done.

-

Measure retention signals: Do users come back without you chasing them?

-

Only then scale features: Add what unlocks pricing tiers or reduces churn.

If you want to move fast without hiring a full team up front, Quantum Byte’s AI-powered builder can help you turn a plain-English spec into a working prototype quickly. Start with an entry-level subscription so you can validate the workflow, then expand it once you have real user feedback.

For a clearer picture of how these tools work behind the scenes, see how an AI app builder works.

Turning a profitable app type into a real product (without friction)

Once you know the category and model, the execution is about turning chaos into a system.

-

Start with a strong data model: Customers will forgive a simple user interface (UI). They will not forgive messy data.

-

Design pricing around limits: Seats, projects, clients, usage, and advanced reporting are easy to understand.

-

Build for support-light growth: Templates, guided setup, and role-based access reduce hand-holding.

-

Add integrations early: Most profitable B2B apps sit inside a stack, not outside it.

This is where a hybrid approach can be powerful. Use AI to get to a real product fast, then use expert developers for integrations, security, and edge cases as your revenue grows. Quantum Byte is built for that path: prototype in days, then bring in a team when you need production-grade depth.

Key takeaways to pick the right app and make it pay

The question "what type of apps make the most money" has a practical answer: pick app types with pricing power, retention, and a clear path to distribution.

Focus on:

-

Problems that cost money today: Prioritize pains that already show up as time, payroll, errors, refunds, or missed revenue.

-

Business models that compound: Choose recurring or scalable revenue models like subscriptions, usage-based pricing, or a take rate.

-

Niches you can reach: Pick an audience you can actually access through a community, industry network, partnerships, or your existing list.

-

A fast validation loop: Pre-sell, prototype, ship an MVP, then use retention signals to decide what to build next.

If you want a faster way to test ideas without sinking months into dev, build a small, focused app first and validate it with real users with Quantum Byte.

Frequently Asked Questions

Do games make the most money?

Some games earn a lot, but they are a tough path for most solopreneurs. They often depend on huge scale, heavy user acquisition, and live operations. Unless you already have a distribution edge, B2B workflow apps are usually a more predictable route.

Is B2B or B2C more profitable?

Either can be profitable. B2B tends to have higher willingness to pay and clearer ROI, which can make early revenue easier. B2C can scale faster if you can build a habit and have a strong distribution channel.

What monetization model should I choose for my app?

Match the model to the value:

- Subscriptions: Ongoing outcome and recurring usage

- Usage-based pricing: Value scales with activity

- Take rate: You enable transactions

- In-app purchases: You sell digital goods or feature unlocks

If you are selling on mobile platforms, make sure you understand the platform rules and billing constraints early.

How do I know if an app idea will actually make money?

Pre-sell it. The fastest signal is a buyer who commits, even at a discounted pilot rate. If you cannot get anyone to pay or sign a letter of intent, you do not have a business yet.

What is the fastest way to build an MVP that I can sell?

Build one workflow for one niche. Keep the first version narrow, then expand based on real usage. If you want to compress the timeline, an AI app builder can help you go from a written spec to a usable prototype in days, then you can harden it with custom development when the revenue proves the path.